Learn everything on how to start investing for beginners and why it is important to start investing as soon as possible.

Are you compelled by the idea of investing but are overwhelmed and don’t know how to start? If that’s the case, this article will show you everything you need to know in order to start investing the right way.

In my opinion, the biggest misconception people think about investing is the fact that investing is only for wealthy people. That’s 100% false, and we’ll elaborate on how you can still start with little money later.

But what is investing, you may ask. Well, it’s actually quite simple.

The whole idea of investing is the act of committing your money with the hope of earning a financial return. People usually invest to make more money, achieve passive income, or retire early.

In this article, I will walk you through everything you need to know in order to fully dive into the investing world and start making your first money.

How to start investing as a beginner

- Invest as safe as possible

- Decide what to invest in

- Choose an investment platform/app

- Beginner investing mistakes to avoid

This article may contain affiliate links. Please read the Disclaimer to learn more.

Why you should start investing as early as possible

You may have heard people repeatedly say that starting investing early in your life is crucial. And that’s actually true. The earlier you begin, the more you will earn.

Those who start investing early have more time for their money to grow and generate wealth.

We are going to talk about two important reasons why you should start investing as soon as possible. Compounding and Inflation.

Compounding Earnings

Have you heard the term compounding before? If not, let me explain. Compounding is the art of making money from your money.

How it works is simple. Let’s say you invest money and after some time you earn a return on your investment (ROI). You then invest your ROI to make even more money.

That’s what’s called compounding earnings and it is used by many people to grow wealth almost on autopilot.

“Compound is the 8th wonder of the world” – Albert Einstein

So instead of working your whole life, sacrificing your time for money, you can let your money smartly work for you. It’s one of the best forms of passive income.

Inflation

If you still think that having your money sit in your bank account is okay, I have one word for you.

INFLATION.

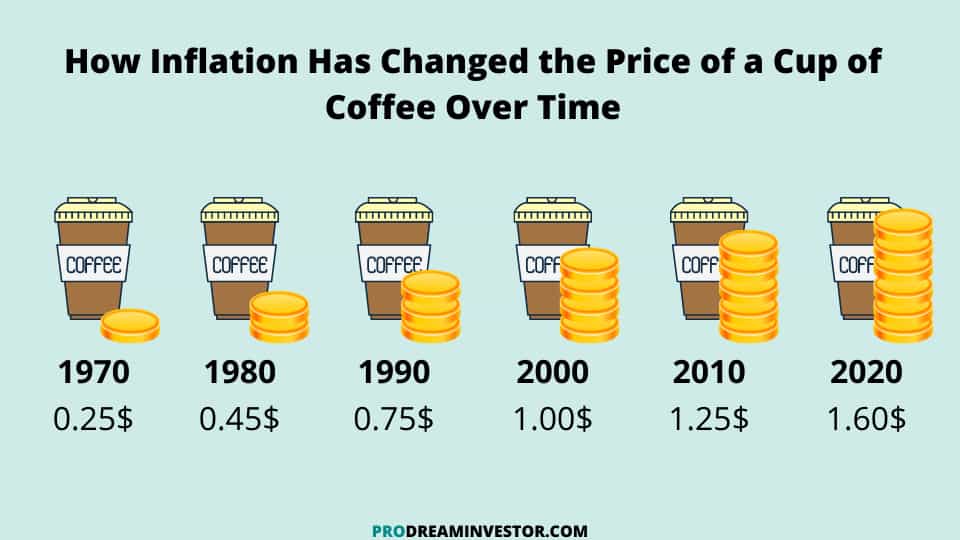

Inflation is basically the decrease in purchasing power over time for a currency.

Money loses value over time and that’s a fact. Just take a look at how much a cup of coffee used to cost back then compared to now.

So, even if you leave your money untouched in your bank account, you will still lose money because of the increasing inflation rates.

For example, let’s say you need $150 to buy your monthly food supplies. Next year you won’t be able to buy the same stuff with these $150. You will need more than $150 because your money will have lost its purchasing power.

Check out the USA inflation rates and you will better understand how inflation works over time.

How to start investing for beginners

Let me start by saying this. The best investment you will ever make is in yourself. This is where everything starts. If you are not willing to invest in yourself, then you won’t be able to achieve your goals.

And by investing in yourself, I mean mainly investing your time and money learning about what you want to improve on.

For example, if you want to get better at chess, you have to invest your time in learning about it. Either by watching videos online, playing with friends e.t.c.

Investing in yourself can make a huge difference and it can help you in many ways. You can improve your skills, knowledge, finances, and every other aspect of your life.

On the other hand, let’s go ahead and talk about how investing your money works.

First of all, when it comes to investing your money you have to make sure to pay yourself first. If you are struggling to make a living and don’t have extra money for investing, you should not even consider it.

Secondly, it would be better to pay off all of your high-cost debts before you start investing your money.

Investing can be risky, and it should never be done with money you may need for your living.

You should only start investing if you have extra money that you are not going to be needing for yourself anytime soon.

If you want to start investing, I would advise you to save some excess money every month and put that amount in a savings or investment account that you can solely use for investing.

If your excess money isn’t a lot, you can save up even more money by reducing your monthly expenses.

Keep in mind that generally, when it comes to investing, it’s better to have a long-term mentality. Short-term earnings can sure seem fascinating, but the real profit comes from long-term investments.

In fact, many expert investors have stated that long-term investments are key when it comes to retiring early, and I totally agree.

Imagine if you saved $300 every month from the age of 25 to 65. At 65, you would have $144.000, right? Now imagine investing that same $300 every single month.

Statistics show that the annual average stock market return is 10%. So instead of letting that money sit in your bank account, you could invest it and make it at least $720,000 by the time you are 65.

Investing is actually the number one way to get rich. Have you ever wondered why the rich become even richer day by day? Well, investing is one of the reasons.

In my opinion, young people should know about investing from an early age because it can literally make a huge difference in their lives.

How to invest as safely as possible (don’t skip this)

Let’s be honest. When it comes to investing, there is always a risk. There is no such thing as being 100% safe when investing your money.

That’s when emergency funds come into play. Before starting investing your money, it is highly recommended to have an emergency fund on the side.

An emergency fund is simply money that you put aside for when an emergency hits. Not many people do this but it is essential and it will give you some peace of mind knowing that if things go wrong, you are going to be prepared.

Lots of unexpected things can happen at any moment, for example, a car repair, a job loss, a medical emergency, and much more. For that reason, it is better to be safe than sorry.

How to build an emergency fund

Building an emergency fund isn’t something you can do overnight and it can definitely take some time depending on your situation.

Having that in mind, you will have to put aside 3 to 6 months’ worth of your monthly income in a checking account and keep that money untouched unless an emergency happens and you really need them.

I advise you to start depositing a small portion of your monthly income into your checking account so that you can slowly start building your emergency fund.

How much you are gonna deposit every month depends on your monthly expenses and financial situation so don’t get discouraged if it’s not a lot.

I would generally say to deposit at least 10% of your income every month.

*SPECIAL OFFER* SAVE 70% ON BLUEHOST HOSTING! Start your own blog with only $2.95/month (Normally $10.99) and build your online business today!

Check out my step-by-step guide and start your blog today!

What to invest in?

Now that we know that investing is a great way to grow your money, I am pretty sure your next question is what should you invest in, right?

Well, there are many options when it comes to investing your money. Some of them are on the safer side and others are riskier.

Let’s take a look at the most popular investments today. The following options are ordered by risk from lowest to highest.

Bonds (Pretty Safe)

A bond is one of the safest options when it comes to investing, and it’s simply a loan that you give to someone in exchange for interest.

It is considered one of the safest investments because there is a legal contract between the lender and the borrower. Of course, there is always a chance for you to lose your money if the people you bought the bond from, go bankrupt.

In general, there are two kinds of Bonds. Government Bonds and Corporate Bonds.

Both Governments and corporations issue bonds frequently for their expenses or to fund new projects.

For example, let’s say a government issues a bond to raise money for the creation of a new basketball stadium. Each bond costs $1000 and offers a 5% annual interest.

So after 5 years, the bondholder will get his money back ($1000) plus the interest which is $250 (5% of $1000 = $50 annually).

There are some independent third-party agencies that rate how trustworthy a borrower is, so you should definitely check them out if you want to find trustworthy bond issuers.

ETFs (Exchanged-Traded Funds) (Safe)

An exchange-traded fund (ETF) is a combination of stocks, bonds, and other assets.

ETFs are a great choice if you don’t want to put all your eggs in one basket. That way, if one asset of the ETF drops, it won’t affect your current balance as much.

S&P 500 for example, is a popular ETF that contains assets from 500 large companies and it is often used by investors as one of the safest choices.

Some of the most popular ETFs these days are the following:

- SPY – SPDR S&P 500 ETF.

- VOO – Vanguard S&P 500 ETF.

- QQQ – PowerShares QQQ ETF.

- GLD – SPDR Gold Shares ETF.

ETFs are a very flexible option as they can be bought and sold at any time. As you can see investing in an ETF isn’t as risky and it is highly recommended for both beginners and more experienced investors.

Stocks (Risky)

A stock simply represents an ownership share of a company.

People buy stocks with the intention of earning a return on their investment (ROI).

When the company you bought a stock from gets wealthier, you also get a share of the company’s profits. Meaning that if you bought a stock at $300 and the company gets wealthier, the same stock you own now can be worth $500 or even $1000.

“Why are there stocks to be sold in the first place” you may ask. And the answer is that companies sell stocks intending to raise funds so that they can operate their businesses.

Some famous companies are Facebook, Google, Amazon, Apple, Netflix, Disney, Microsoft, and Tesla.

Real Estate (Risky)

Real estate investing is basically when someone buys a property with the intention to make a profit out of it in various ways.

Owning a real estate property includes all the physical things around the property as well. That can include yards, garages, gardens, e.t.c.

Some of the ways people can make money from real estate include:

- People buy undervalued real estate to fix it up and sell it later for a profit

- People buy real estate for renting and making a profit in the long run

- People buy real estate to make a profit from rental in the long run

- People buy real estate to make a profit from business activity

Investing in real estate can be tricky at times and it definitely requires a lot of knowledge and patience so I wouldn’t recommend it for beginners.

How much money do you need to start investing?

The good news is that you don’t need much money to start investing. You can start investing with as little as $5 and that’s because many brokerages require no minimum amount of money to get started.

Most of them also hold 0% fees, so that’s another plus.

My first investment ever was only $5 and that’s because I wanted to get the hang of it before putting in more money. I kept investing with less money for some months until I got familiar with how it works.

After that, I started investing more and more money.

You may think that it’s not worth investing small amounts of money but let me tell you this. When you first start out, it’s not about making money. It’s about learning how to invest. So take it as a learning period that is surely going to prove useful for you in the long run.

So, start with little money, get the hang of it, and as your knowledge increases, start investing more.

Related Articles:

- 15 Best Weekend Jobs to Make Extra Money ($50/ Hour)

- How to Start a Blog (and Make Money) in 2024: Easy Guide to Start Blogging Today

- 20 Legit Part-Time Night Jobs From Home ($1000/ Week)

- 15 Best Online Paid Focus Groups (Make $300/ hour)

- 16 Best Online Jobs for Teens That Pay Well ($50/Hour)

- Get Paid to Be a Virtual Friend (Earn $50/Hour) In 2024

The best investing apps for beginners

There are many investing apps out there but not all of them are suited for beginners investors.

So with that in mind, let’s go ahead and look at some of the best investing apps for beginners that you can download and start using right away.

Acorns

Acorns is one of the best apps when it comes to beginner investors and that’s because of its simple UI and easy-to-navigate interface. You can easily invest, and withdraw your money without unnecessary clutter and that’s what makes it one of the best choices for beginners.

Acorns currently has 2 plans you can choose from. The Personal one (All-in-one) will cost you $3 per month and the Family one will cost you $5 per month. Most people use the Personal plan because it has everything you need to start making money from your investments.

M1 Finance

M1 Finance is another good choice for beginner investors. This app also has a pretty simple user interface and offers great portfolio management.

Something I really love about this app is the M1 Community Pies feature. Community Pies are a sum of many stocks or ETFs and they are a really good choice when you don’t know where to invest as a beginner.

It is also worth noting that M1 Finance has no commissions and low account minimums.

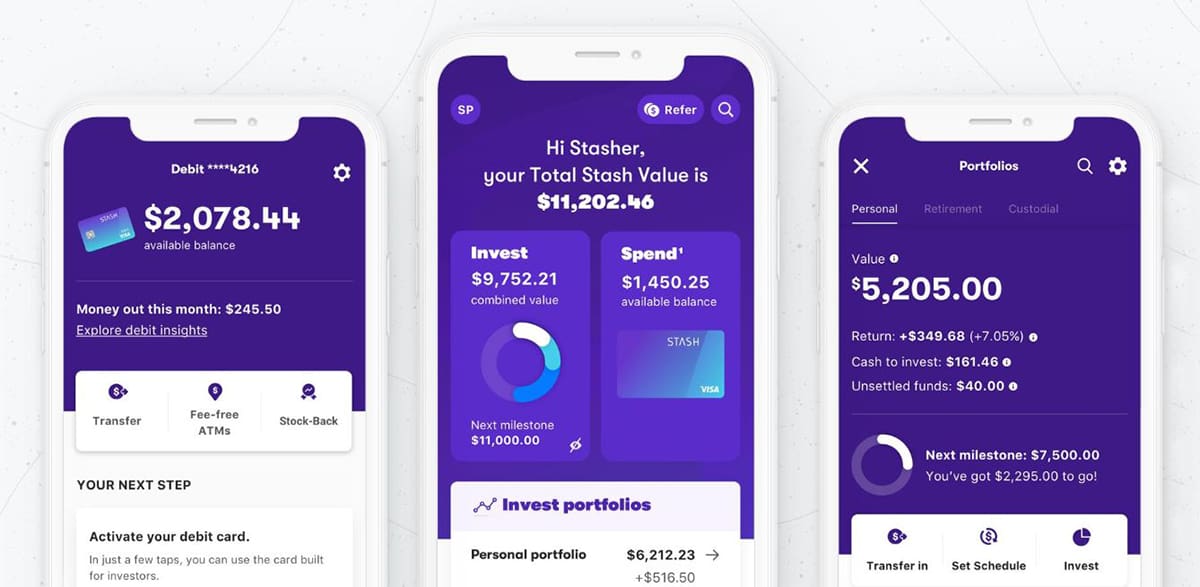

Stash

Many beginner investors choose the Stash app as their first investment app because of how simple it is.

With Stash, you can automate your investing by letting the app draw money from your bank account to your Stash personal portfolio every month. That way you can build your portfolio and use it to invest in stocks or ETFs whenever you feel ready.

For example, you can set it to withdraw $10 every week or $100 per month. Depending on what your income looks like, you might want to withdraw less or more money of course.

Stash offers hundreds of individual stocks and ETFs.

Last but not least, Stash offers 3 plans for you to choose from. Stash Beginner ($1/month), Stash Growth ($3/month), and Stash+ ($9/month).

Grab my FREE eBook to discover your perfect online job and learn how to get started today.

Stop trading your time for money and join millions of people working online!

Public

Public is another trustworthy app for investors. You can open an account pretty easily and start investing right away. You can invest in stocks, ETFs, and crypto all in one place.

When it comes to buying stocks, Public has a thing called fractional shares. That simply means that you can buy a slice of a particular stock instead of the whole stock.

For example, as of this moment, 1 apple stock costs $172,38. This may be too much for some people, but with fractional shares, you can own a fraction of the stock. This can be $1, $10, $50, or whatever amount you choose depending on your budget.

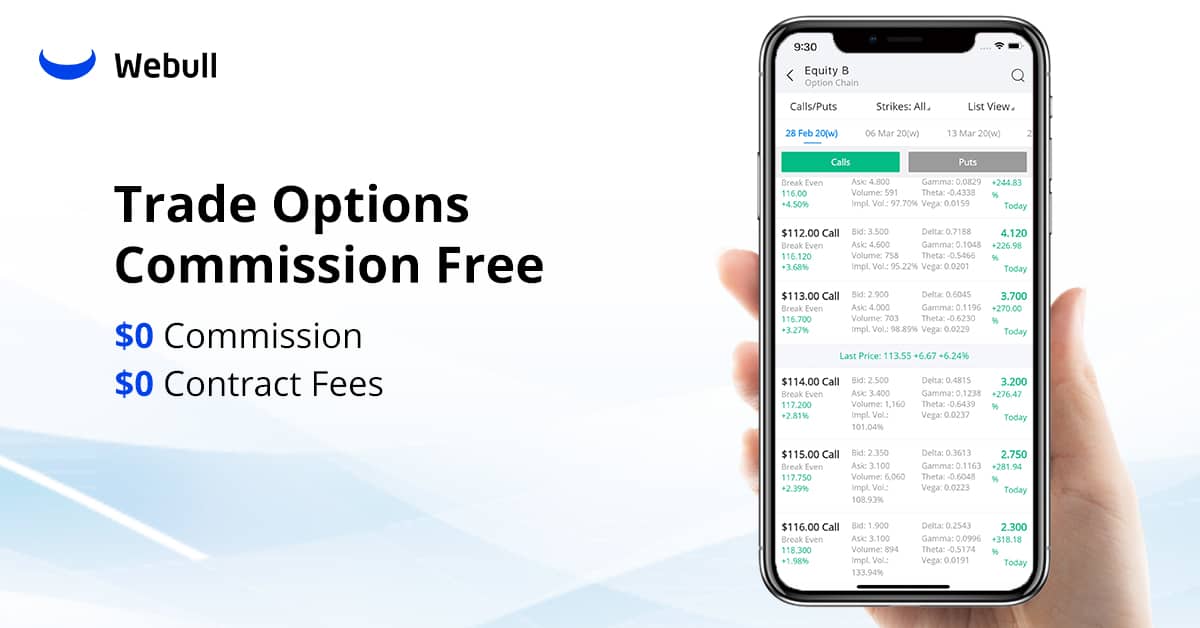

Webull

Webull is an excellent app for beginners with lots of analytics for you to use. It’s a well-designed and user-friendly platform that can help you dive into the world of investing.

It may indeed seem more complicated than the rest of the apps I recommended but it’s still simple enough to understand and at the same time provides more information for someone that wants to do some more analysis.

It has no minimum deposit or platform fees, and you also have access to 11 different cryptocurrencies.

If you want to see a complete and detailed list of the best investing apps by region (including the USA, Canada, Europe, and the UK) check out my best-investing apps by region article.

Beginner investing mistakes to avoid

When we start something new, we always make mistakes, and that’s to be expected. But when it comes to investing, mistakes can cost a lot.

So let’s go ahead and see the most common mistakes beginner investors make when they first start their investing journey.

Investing before you are ready

Some people start investing their money before knowing if they are actually ready or not, which is one of the biggest mistakes you can make. If you barely have money for yourself or your family then it’s not a good idea to start investing.

That would mean that at the end of each month you barely have money left at your disposal.

Moreover, as I mentioned above, don’t even think of starting investing if you have unpaid debts.

Last but not least, not having an emergency fund in place or struggling to build one is another strong indicator that you should not start investing.

Making emotional decisions and lack of patience

One of the most important things you have to implement if you want to become a successful investor is self-control. And that means not letting your emotions take the wheel when it comes to decision-making.

Investing is purely a logic game, and you should act like that if you want to make money.

For example, you may love a brand and want to invest your money in it just because you “feel” it’s going to perform well.

You have to put your feelings aside and see things from an unbiased perspective if you want to succeed in investing.

Not giving your investments time to grow

Some people may withdraw their money too early because of fear or impatience, and that can literally make them lose their money when in reality, they could make a lot more if they simply let their investments sit there a bit longer.

For example, let’s say you just bought a Microsoft stock worth $300. After three months this stock decreases by 20% and you fear that it will keep going down so you withdraw your money to spare yourself from losing more money. You just lost $60.

But, if you simply waited longer, that stock would most likely go up again and even surpass its initial price. So not only you wouldn’t lose money but you would actually make some more.

Following the herd

Another mistake beginner investors make is the fact that they blindly follow other people’s advice or actions. It can sure seem tempting to follow what other people are doing because the more people choose something, the wiser the choice, right?

Well, that’s not always the case.

When you want to invest in something you should always do your own research and trust your gut. That way not only you will learn from your mistakes and get better, but you will also save yourself from regret.

Putting all your eggs in one basket

When you first set your foot in the world of investing, it’s best to diversify your investments. I wouldn’t recommend investing all of your money in one asset. Instead, try to buy an ETF or diversify your investment into multiple stocks.

That way if one stock goes down, your balance won’t be seriously affected.

Diversification is a great way of reducing risk and you should definitely think about diversifying your investments when you first start.

Useful investing resources

- investopedia.com

- yahoofinance.com

- whalewisdom.com

- jika.io

- tipranks.com

- finviz.com

- freestockcharts.com

Join the Newsletter

Sign up and get FREE access to the best strategies on how to become financially free!

Final Thoughts

I hope this investing for beginners guide helped you realize that investing isn’t as scary as some people think. On the contrary, investing can be a great way to build wealth, especially if you start at a young age.

Many people have achieved their financial goals because they know how to invest the right way and you can definitely do that too.

Regardless of your goals and what you want to achieve in life, investing can be a very important step for you and your career, so I highly recommend you give it a chance.